Jan 15, 2026

Case Study

TL;DR

Vision (VSN) launched on July 16, 2025, as a joint effort between Bitpanda and the Vision Web3 Foundation, utilizing Arrakis Pro from day one to manage onchain liquidity on Uniswap.

The Arrakis-managed Uniswap pools showed ~55% greater depth at 1-2% levels than the primary CEX venue, meaning traders could often execute larger sizes onchain with less slippage than on the leading CEX.

To deliver identical depth, a full-range deployment would have required up to 3× more capital, freeing up the Vision Web3 Foundation’s Web3’s treasury for other priorities.

Realized volatility on Uniswap was up to 40% lower than on the primary CEX venue throughout the analysis period, with the gap widening most during the October 10th cascading event, giving holders a more stable venue to trade through turbulence.

Uniswap captured ~20% of total VSN spot volume post-TGE, ahead of MEXC, KuCoin, and Kraken individually, proving onchain liquidity can compete with CEX listings when managed properly.

Setting the Stage

On July 16, 2025, the Vision Web3 Foundation launched VSN in collaboration with Bitpanda, creating a unified token by merging the existing Bitpanda Ecosystem Token (BEST) and Pantos (PAN) into a single asset designed to operate across Bitpanda's platform and the broader Web3 ecosystem.

For a token unifying two existing ecosystems, the onchain liquidity strategy was important. They needed sufficient depth to handle organic distribution, support price discovery across venues, and maintain stability during volatile periods. The open question was whether a DEX could deliver that from day one, or whether onchain would remain a secondary venue trailing CEX depth.

"For a launch of this scale, we needed onchain liquidity that could compete with our CEX listings from day one. Arrakis Pro gave us active management that kept depth where traders actually execute, not a passive LP solution we'd have to monitor constantly." - Leon Marino, Senior Product Manager, Bitpanda Web3

From day one, the Vision Web3 Foundation utilized Arrakis Pro to deploy and manage concentrated liquidity on Uniswap, ensuring smooth onchain execution, anchoring price stability during volatile periods, and supporting organic token distribution beyond centralized exchanges.

This case study evaluates Arrakis Pro's impact on liquidity depth, execution stability, and spot volume participation relative to CEX markets over the post-launch period.

Analysis period: July 16th 2025 (TGE) to November 1st 2025.

Liquidity Depth: Uniswap vs. Gate.io

Liquidity depth determines whether traders can execute size without moving the market against themselves.

Gate.io led price discovery for VSN post-TGE, making it the venue where new price information was reflected first, with other venues following.

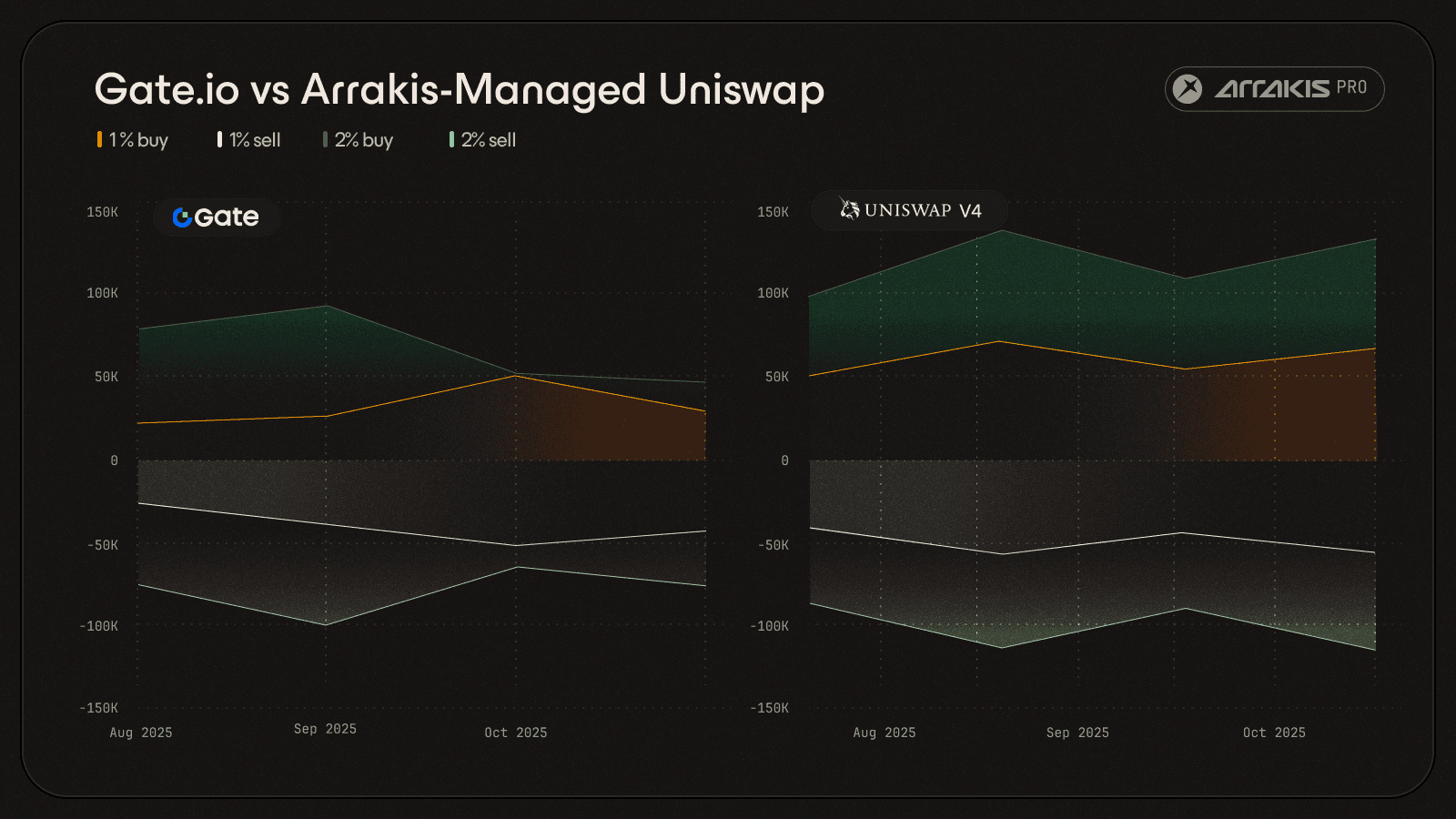

To benchmark onchain performance, we compared the liquidity depth between Arrakis-managed Uniswap pools (VSN/ETH and VSN/USDC on Ethereum, aggregated) against Gate.io's VSN/USDT orderbook using monthly snapshots from August to November 2025.

Arrakis-managed Uniswap pools showed ~55% greater depth at 1-2% levels than Gate.io across all monthly snapshots.

Metric | Gate.io | Uniswap V4 |

Avg 1% aggregate depth | ~$70,055 | ~$108,776 |

Avg 2% aggregate depth | ~$139,891 | ~$216,552 |

Across all snapshots, Uniswap showed greater average liquidity depth at 1% and 2% levels, translating to lower expected slippage for spot trades onchain than on the primary CEX venue.

Depth on centralized exchanges depends on market makers actively quoting. They typically expose only a fraction of their capital as resting orders and can pull liquidity instantly during volatile periods to protect their positions.

Arrakis-managed liquidity operates differently: fully deployed onchain and concentrated around the current price. Arrakis continuously rebalances ranges to keep depth near spot, so traders can execute knowing liquidity is structurally present, not contingent on a market maker's willingness to quote at any given moment.

Why Depth Isn't Just About TVL

These results raise a natural question: how much capital did it actually take to outperform Gate.io's depth?

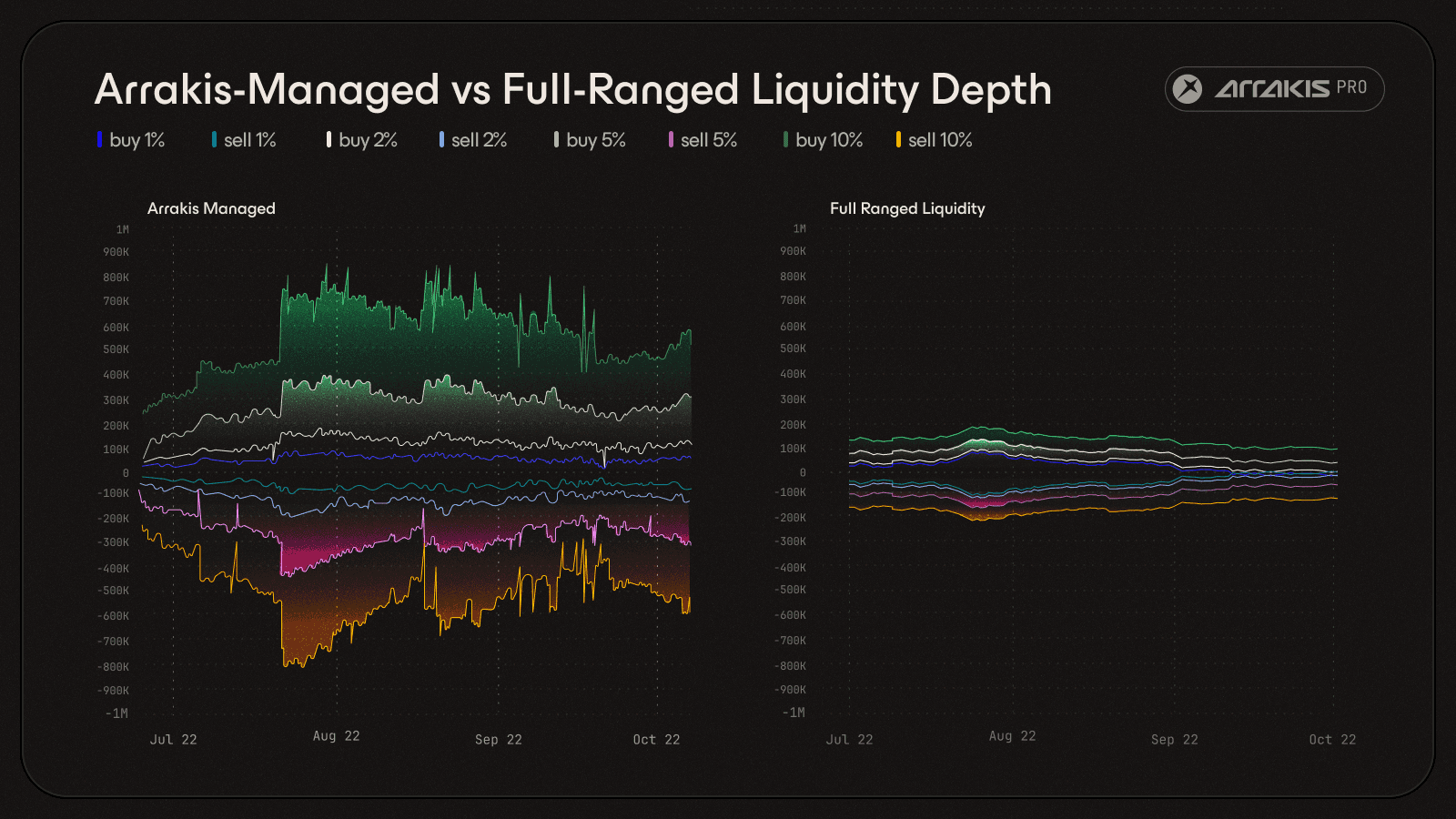

A common assumption is that liquidity depth scales linearly with TVL. In practice, depth depends far more on how liquidity is deployed.

Many projects use full-range positions where liquidity spreads evenly from zero to infinity. While simple to set up, the majority of capital sits inefficiently at prices where trading never happens.

Arrakis Pro concentrates liquidity around the current price and rebalances as the market moves. To quantify the difference, we simulated VSN's depth under a full-range deployment with identical capital.

Concentrated management (left) delivered up to 3× greater depth per dollar deployed versus passive full-range positioning (right).

To match the 2% depth Arrakis Pro achieved, a full-range position would have required up to ~3× more capital. For issuers, this is the difference between deploying treasury liquidity efficiently versus overfunding to achieve the same execution quality.

Volatility and Execution Stability Under Stress

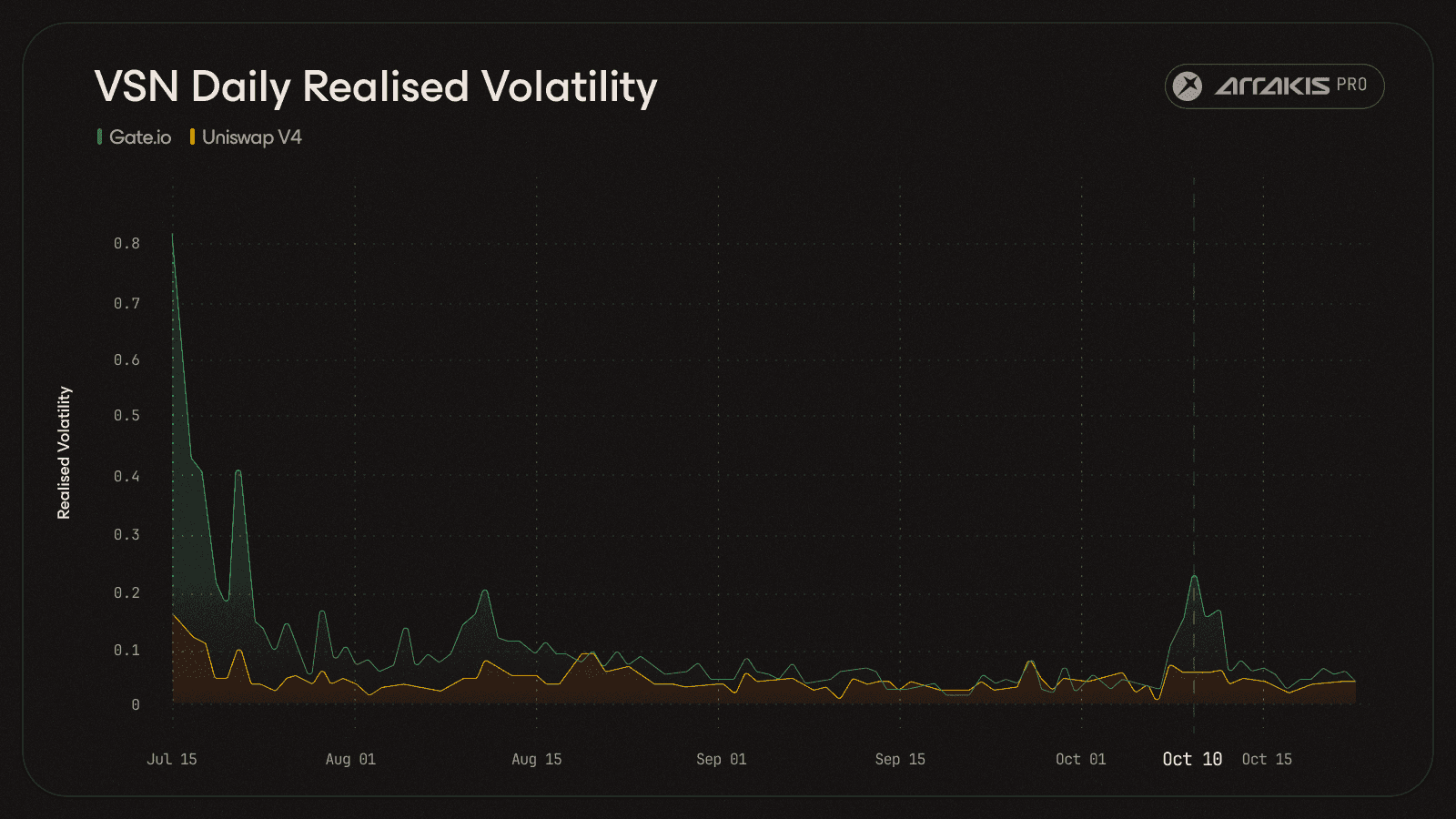

On October 10th, 2025, the crypto market experienced a cascading liquidation event. More than $19B in leveraged positions liquidated in a single day, triggering sharp moves across most trading pairs. Events like this reveal whether onchain depth holds up under pressure or disappears when it's needed most.

VSN markets diverged sharply across venues. Centralized exchanges saw abrupt price swings as market makers started quoting conservatively to hedge inventory. The Arrakis-managed Uniswap pool held: depth stayed near spot, allowing the onchain market to absorb flow without the same gap risk.

Uniswap's realized volatility remained up to 40% lower than Gate.io, with the gap widening most during the October 10th liquidation cascade.

Throughout the analysis period, realized volatility on the Uniswap V4 VSN/USDC pool ran up to 40% lower than Gate.io's VSN/USDT market, with the gap widening most during the October 10th event.

This stems from Arrakis Pro's ability to keep liquidity in-range during fast moves. Rather than liquidity gaps amplifying price swings, depth remained available close to the market price even as conditions deteriorated.

Volume and Market Share

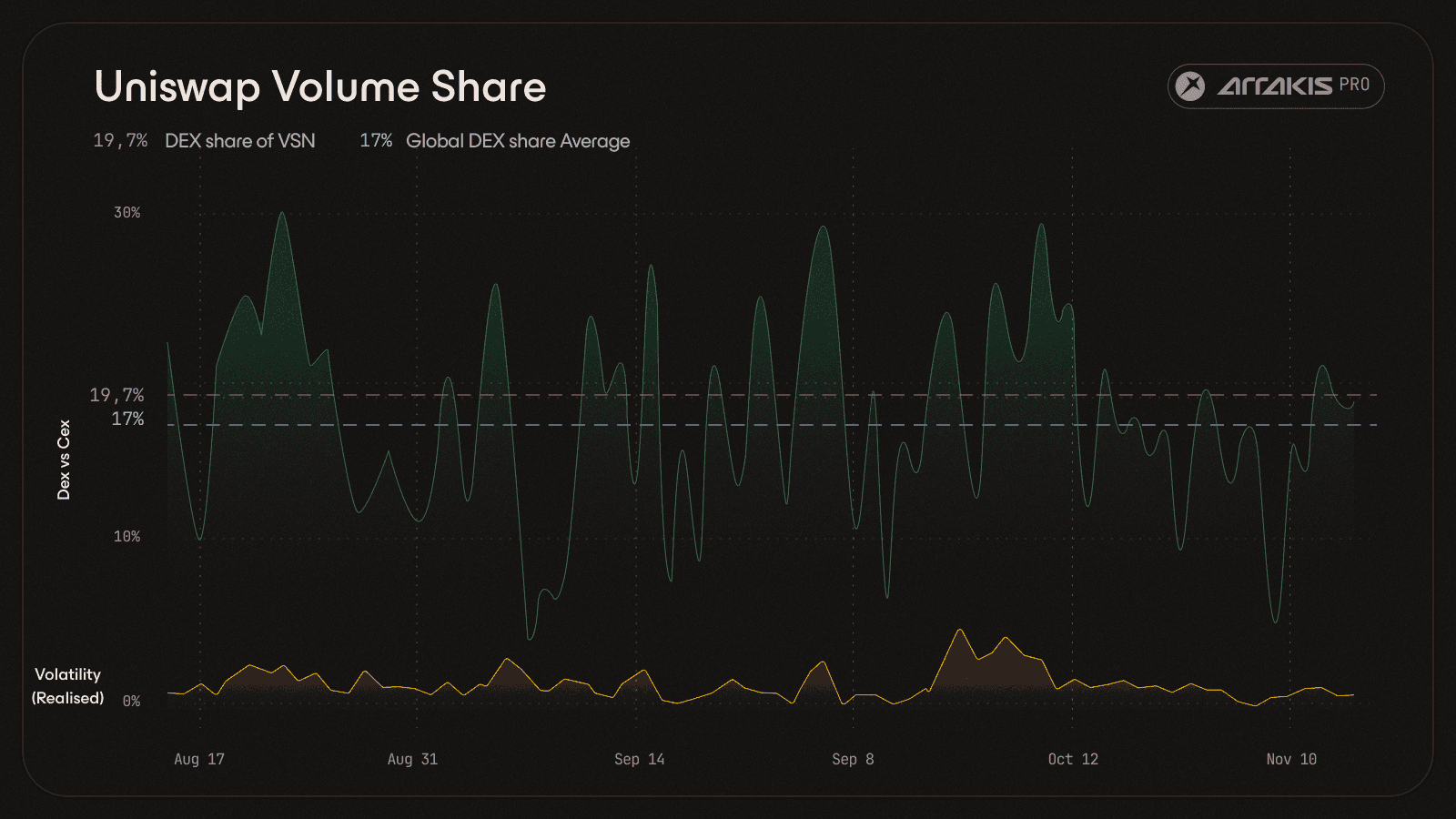

During the immediate TGE phase, centralized exchanges dominated VSN volume. Speculative demand and CEX-CEX arbitrage concentrated early flow on Gate, MEXC, KuCoin, and Kraken.

However, as the market stabilized from mid-August onward, the Arrakis-managed Uniswap pool captured ~19.7% of cumulative volume, more than MEXC, KuCoin, or Kraken individually, trailing only Gate.io.

Uniswap's volume share expanded during volatility spikes, a signal that sufficient depth was available for arbitrageurs to execute against.

Daily Uniswap share remained above global DEX averages and increased during volatility spikes. When volatility rises, CEX prices move faster and the price gap between venues widens, creating arbitrage opportunities that pull volume onchain.

Uniswap capturing more share during turbulent periods signals that sufficient depth was available for arbitrageurs to execute against. For issuers, this is the proof point: a well-managed onchain venue doesn't just complement CEX listings, it can even outperform them.

What This Means for Token Issuers

The VSN case demonstrates that with concentrated and actively managed liquidity, DEX markets can match or exceed CEX depth from launch, using less capital while maintaining consistent execution even through volatility.

If you're preparing for a TGE or looking to strengthen post-launch liquidity, fill out our contact form to discuss how Arrakis Pro can deliver similar results for your token.