Feb 4, 2026

Announcement

TL;DR

Uniswap's Continuous Clearing Auction (CCA) enables projects to bootstrap onchain liquidity through fair price discovery, broad participation, and automatic liquidity seeding into Uniswap v4. By default, CCA seeds liquidity as a full-range position, which spreads capital across the entire price curve. Teams that migrate to actively managed concentrated positions with Arrakis can achieve deeper markets, higher fee capture, better price alignment during listings, and lower downside volatility.

Because CCA liquidity is committed for an extended period after clearing, decisions about post-auction liquidity operations should be made before the auction begins.

CCA handles price discovery and liquidity boostrapping. Quote asset inventory like USDC and ETH gets bootstrapped efficiently by buyer demand; liquidity seeds automatically at auction close.

Full-range positions leave most capital idle. Only a fraction sits near the trading price where swaps occur, losing the LP fees, leading to lower liquidity depth and worse trader experience.

Active management post CCA upgrades the LP performance. Improved trading experience and higher LP earnings thanks to concentrated range management, continuous automated rebalancing, dynamic fee adjustments and yield capture.

Arrakis was among the earliest adopters of Uniswap v4, managing over $50M in TVL across 50+ projects and pioneering novel v4 hook integrations, including dynamic fee adjustment, price convergence, and yield boost mechanisms. With CCA, teams can leverage Arrakis’ powerful liquidity infrastructure to optimize post-CCA operations from day one.

CCA and Price Discovery

Liquidity formation traditionally happens behind closed doors. Offchain deals, privileged allocations, and opaque pricing create information asymmetries that benefit insiders while leaving markets thin and unstable.

Uniswap's Continuous Clearing Auction is a DeFi native and fully onchain token auction experience with open participation and transparent price discovery. It introduces a structured approach to token distribution by extending uniform-price auctions into continuous time. Tokens are sold gradually, and clearing prices are set by real demand across the duration of the auction. The entire process runs onchain with no gatekeepers.

How CCA improves token distribution mechanisms:

Mechanism | Core Problem | How CCA Improves |

Fixed-price sales | Arbitrary pricing, priority races | Market-driven clearing prices reflect real demand |

Dutch auctions | Sniping, last-second timing games | Continuous clearing reduces one-shot risks |

Bonding curves | MEV extraction, sandwiching, path-dependency | Bid spreading and periodic clearing reduce manipulation risks |

LBPs | Sophisticated traders exploit weight dynamics | Uniform clearing per block provides stronger fairness |

Airdrops | Sybil attacks, immediate dumping, no price discovery | Adds market pricing and automatic liquidity seeding |

CCA’s auction mechanism provides solutions to the above listed problems. Timing games and sniping are largely eliminated. Distribution is broader and more credibly neutral. Participation is determined by exposure to clearing periods rather than transaction ordering. A liquidity pool is automatically seeded, driving deep liquidity at market-driven prices from the start.

Aztec Network's December 2025 token auction demonstrated the mechanism at scale, raising approximately $59M from 16,741 participants with 30-40% lower volatility than comparable formats. Further, analysis by Uniswap Labs confirmed that Aztec’s CCA had zero identifiable snipes. A full case study analyzing their auction is available at:

When the auction ends, proceeds and reserve tokens seed a Uniswap v4 pool at the final clearing price. A position NFT is minted to the designated recipient, and liquidity is live immediately.

At that point, the auction phase is complete.

The State of Liquidity After CCA

After a CCA, the issuer holds a Uniswap v4 position NFT representing their position in the liquidity pool set as a full-range position.

In a full-range position, liquidity is distributed across the entire price curve, from zero to infinity. This is the appropriate default during price discovery, when the trading range is unknown and extreme moves are possible. Once price discovery completes and volatility normalized, the calculus changes.In the full-range model, only a small fraction of capital sits near the active trading price where swaps occur. The majority is positioned far from current price, optimizing for coverage for extreme moves rather than usable depth.

This design trades-off efficiency for simplicity. A full-range is simple and provides deterministic onchain liquidity. In today's competitive LP environment, however, long term positions can benefit from more efficiency and dynamism. Concentrated liquidity can enable LPs to earn significantly higher fees and provide better market depth with the same capital compared to full range positions. By actively managing their positions, LPs can maximize fee capture and reduce price impact for traders, creating a more efficient market for everyone. While full-range positions serve as the appropriate default during price discovery phases, active management and the use of advanced Uniswap v4 hooks can unlock significantly better performance from the same capital over time.

How Markets Actually Mature

Once trading goes live, three dynamics determine outcomes.

Capital efficiency determines execution quality.

A $6M full-range position can produce ~0.67% price impact on a $10K trade based on historical pool performance. The same capital being actively managed and concentrated around the trading price by Arrakis reduces impact to ~0.16%.

In practice, Arrakis-managed liquidity delivers approximately 4x lower price impact on equivalent-size trades compared to full-range positions, a difference that directly shapes trader experience and volume from day one.

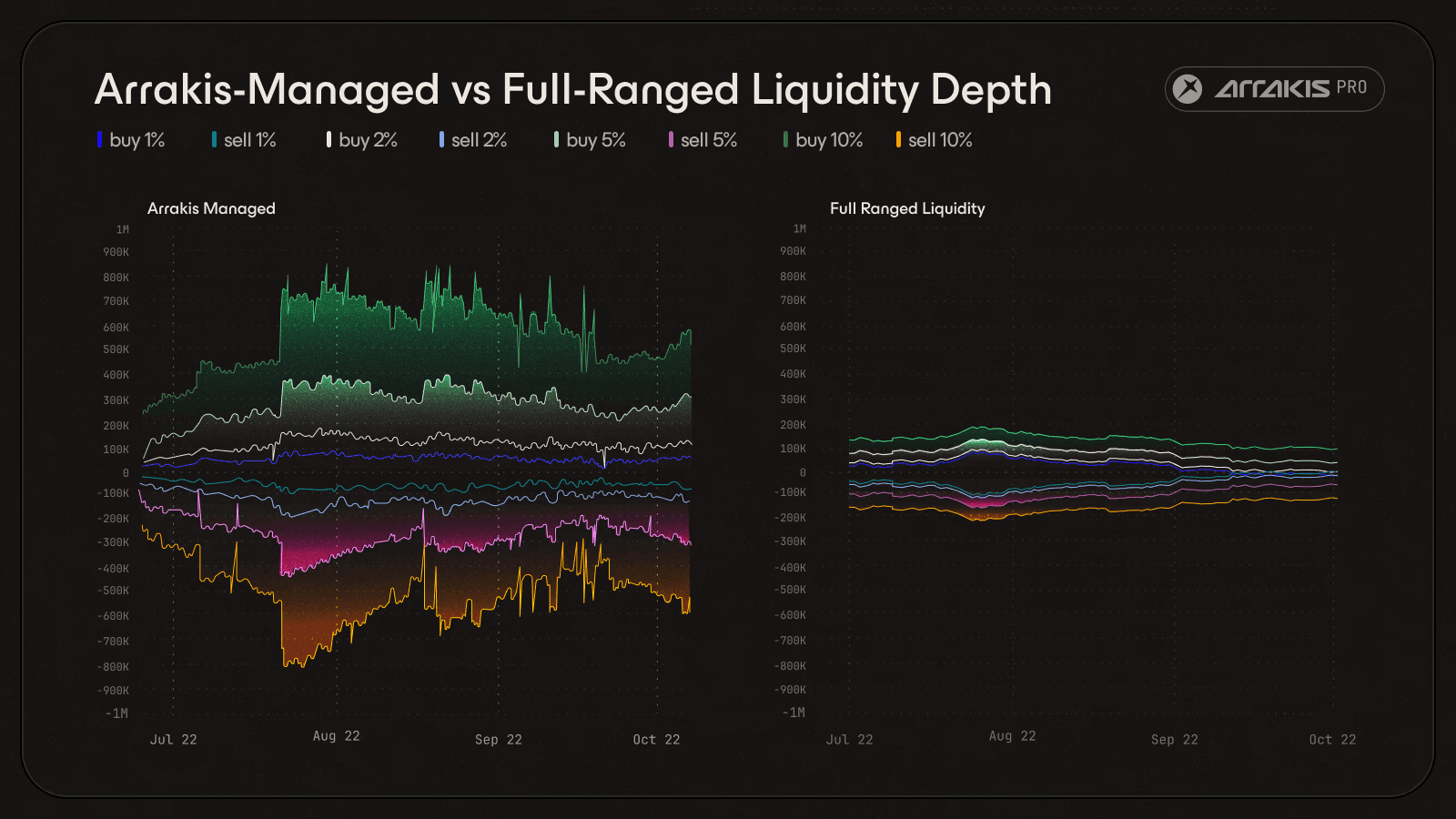

For $VSN, Arrakis' concentrated management (left) delivered up to 4× greater depth per dollar deployed versus full-range liquidity (right).

Execution quality compounds over time: better execution attracts volume, higher volume increases fee generation to LPs, higher fees increase the liquidity on the Uniswap Protocol, and deeper markets reinforce themselves.

Fee capture shifts to active operators.

Once a token reaches scale, external sophisticated LPs typically deploy concentrated positions where trades occur. These positions capture fees more efficiently than large static pools.

Without active management, issuers subsidize market depth, receiving mostly arbitrage flow while others capture the economics.

Static & stale pricing creates arbitrage.

The clearing price reflects demand during the auction window. However, if there is a delay between the CCA and broader availability – including listing in centralized exchanges – prices may diverge across venues. As time passes and CEX listings and additional venues come online, the real market price might have already changed significantly.

Static onchain liquidity cannot adjust. Arbitrageurs fill the gap immediately, extracting value from the LP measured as Loss Vs Rebalancing (LVR) proportional to the price difference and available liquidity. This means the liquidity starts out with a big loss in value that takes time and fees to be recouped.

These outcomes are not specific to CCA. They reflect the natural challenges of maintaining static liquidity in a dynamic market, where price adjustments on the AMM can lag behind real-time conditions.

Two Phases, Two Different Jobs

Token markets move through two distinct phases.

Phase | Objective | What Matters |

Distribution | Fair price discovery, distribution of tokens, and initial liquidity boostrapping | Clearing price reflects demand and quote asset (USDC, ETH) gets bootstrapped |

Post-distribution | Efficient, competitive and sustainable market structure | Depth, execution, fee capture, arbitrage protection and correct pricing |

CCA is purpose-built for the first phase, handling both price discovery and liquidity bootstrapping. The second phase requires active liquidity operations.

Teams that treat initial liquidity as "set and forget" will underperform teams that plan for post-distribution management.

How Teams Can Use Arrakis After CCA

Arrakis is designed for the post-distribution phase. Teams migrate their CCA position into an Arrakis vault. The underlying liquidity remains on Uniswap v4, but instead of sitting in a static full-range position, it is concentrated and actively rebalanced.

With Arrakis:

Liquidity is concentrated around the trading price, producing materially deeper markets with the same capital.

Positions are automatically rebalanced continuously based on price movement, volatility, and inventory composition.

Dynamic fees update based on market volatility and momentum, allowing teams to capture up to 95% of trading fees, instead of leaking value to smaller, more sophisticated LPs.

Arrakis’ Yield boost hook allows LPs to earn around 4-5% yield on their LP assets while earning trading fees at the same time

Liquidity moves in a single atomic transaction, allowing trading to continue uninterrupted. Custody remains with the issuer via a vault NFT and the liquidity never leaves Uniswap.

The Case for Engaging Arrakis Before CCA

While teams can migrate to Arrakis after a CCA completes, engaging before trading starts can unlock additional benefits.

Capital efficiency enables better planning

Understanding how actively managed liquidity performs allows teams to plan capital allocation before the auction. A project that raises $10M through CCA might assume $4M is needed for adequate liquidity depth in a full-range position. With Arrakis managing concentrated positions, the same depth requires roughly $1M, freeing $3M for operational funding, development, or treasury reserves.

Alternatively, deploying the full $4M through Arrakis produces depth equivalent to $16M or more in full-range positions. These tradeoffs are easier to model when post-distribution management is part of the plan from day one.

Price Convergence avoids arbitrage at listing

Because time may pass between CCA completion and wider trading ability, market conditions may shift and prices diverge. If teams choose to list on a CEX following a CCA, the gap between the original clearing price and the new CEX price when CEX trading begins may create immediate arbitrage at the issuer's expense.

Arrakis' Price Convergence feature, powered by Uniswap v4 Hooks, programmatically updates pool pricing to match CEX prices when trading starts. Teams that plan this upfront ensure their onchain price is correct from the moment CEX trading begins, avoiding the value extraction that occurs when prices are misaligned at listing.

Evidence From Live Markets

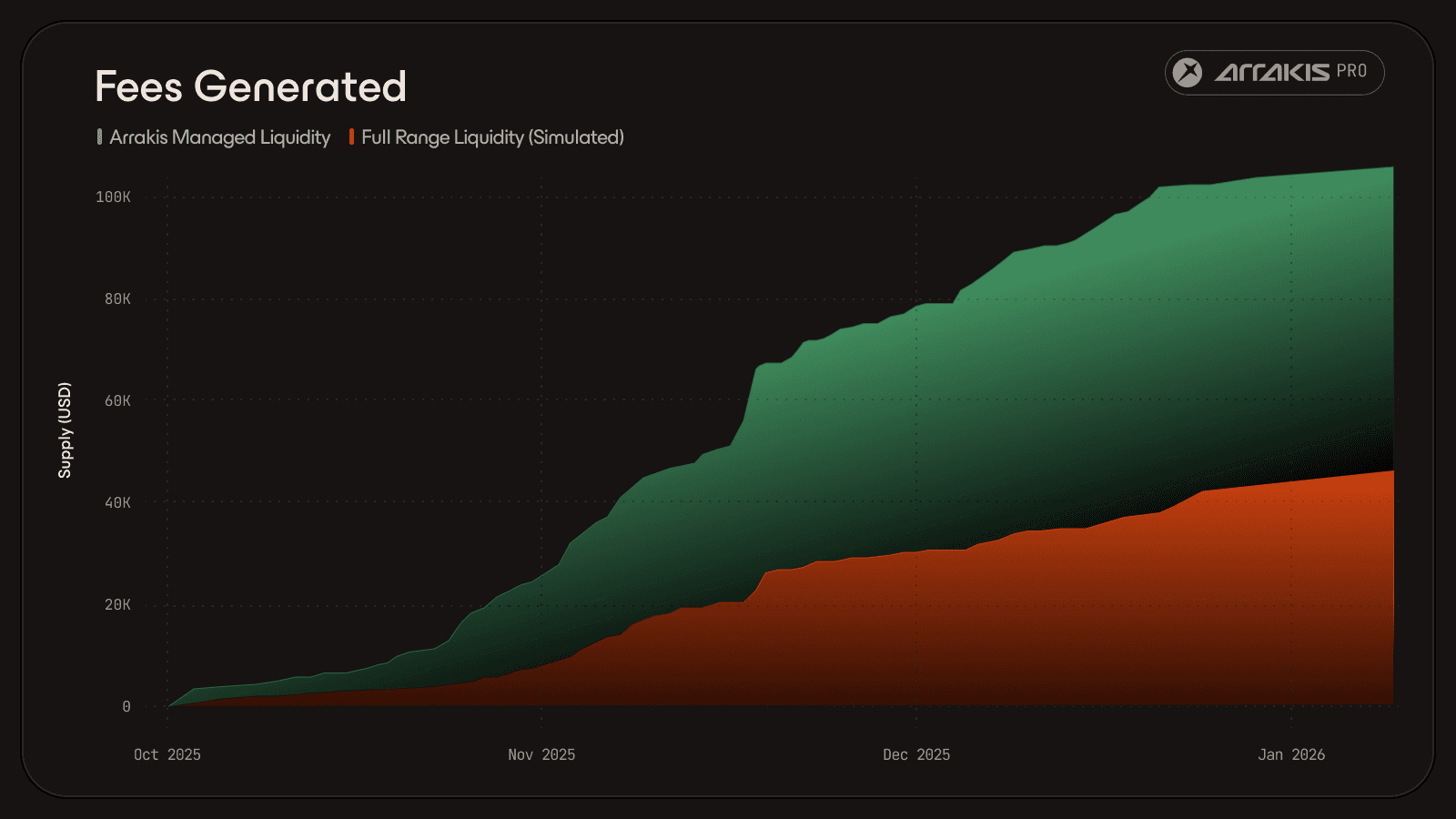

Across live Uniswap deployments, actively managed Arrakis vaults consistently outperform static full-range positions. Historically, Arrakis-managed vaults have seen:

4x deeper liquidity at the trading price

4x lower price impact for equivalent trade sizes

3x higher fee capture relative to static full-range positions

Arrakis Managed shows real performance. Full Range is simulated by applying the same price curve and deriving the volume and fees based on pool depth at the trading price.

These outcomes reflect a consistent pattern: once distribution ends, liquidity performance is an operational problem.

Who This Is For

Active post-CCA management is most relevant for teams that:

Are distributing tokens via Uniswap CCA and want to optimize post-auction market performance

Want to optimize their trading fee capture and overall PNL

Want to avoid arbitrage losses when CEX trading begins after their CCA

Have completed a CCA and currently hold a static position NFT

Care about execution quality, volatility, and fee economics

Want automated liquidity operations without ongoing manual management

Arrakis currently manages liquidity for 100+ protocols, including Morpho, EtherFi, Maple, Bitpanda, Stargate, and Euler.

Planning the Post-CCA Phase

CCA is an effective way to distribute tokens, discover market price, and bootstrap liquidity. Long-term outcomes are determined by how liquidity is operated once CCA ends.

For teams distributing tokens through CCA, the post-auction phase is where market quality is determined, and that phase should be designed upfront. Arrakis works with issuers before CCA to ensure that protocol-owned liquidity delivers deep markets, efficient execution, and durable fee capture once trading begins.

Fill out our contact form to discuss your CCA.