Dec 16, 2025

Case Study

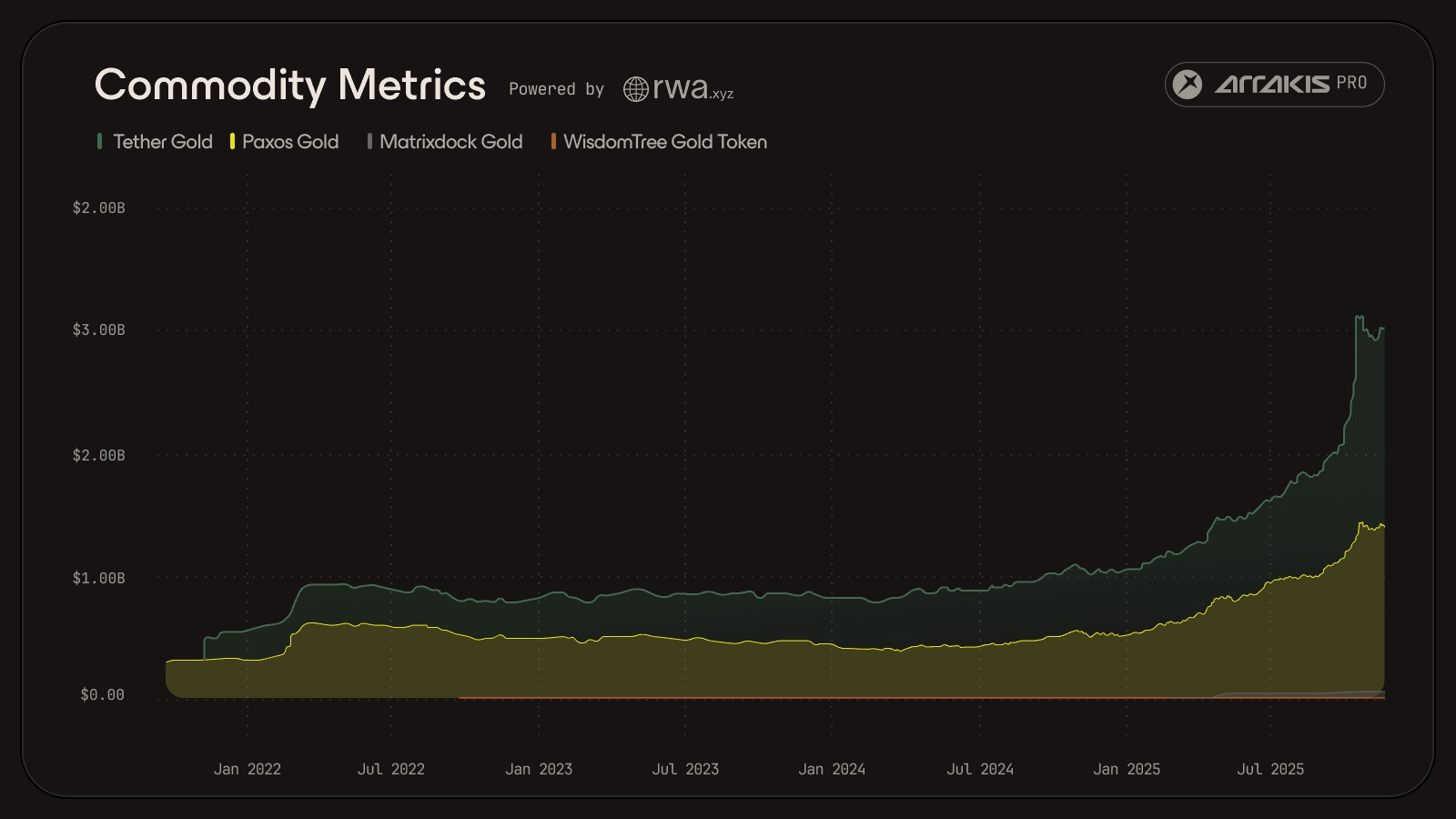

Tokenized gold has become one of crypto’s most resilient verticals in the RWA ecosystem. In less than four years, it has grown from a niche experiment to a multi-billion-dollar onchain asset class, drawing consistent inflows in both risk-on and risk-off environments.

Unlike fiat-backed stablecoins or credit-backed RWAs, tokenized gold is not designed as a payments rail or a yield product. It is a digitally native store of value that carries the same trust premium as physical gold, while adding the mobility, transparency, and programmability of digital assets.

Growth of Gold Onchain. Source: https://app.rwa.xyz/

The next phase is taking shape: moving beyond simple price exposure toward digitally native ownership models with institutional custody, legal clarity, and verifiable provenance.

This is where MKS PAMP’s DGLD® enters the market.

MKS PAMP - A Global Authority in Precious Metals

For over 60 years, MKS PAMP has shaped global standards for how gold is refined, vaulted, certified, and traded. The group operates across the full post-mining value chain:

LBMA-accredited refining of investment-grade PAMP® gold

Institutional vaulting in Switzerland with full insurance

Global bullion distribution, including Harrods and Gold Avenue

Regulated asset infrastructure supported by independent financial and AML audits

MKS PAMP’s refined gold is used by central banks, asset managers, and global bullion markets. PAMP® bars are widely regarded as a benchmark for purity, traceability, and provenance.

Introducing DGLD® - Physical Gold, Natively Digital

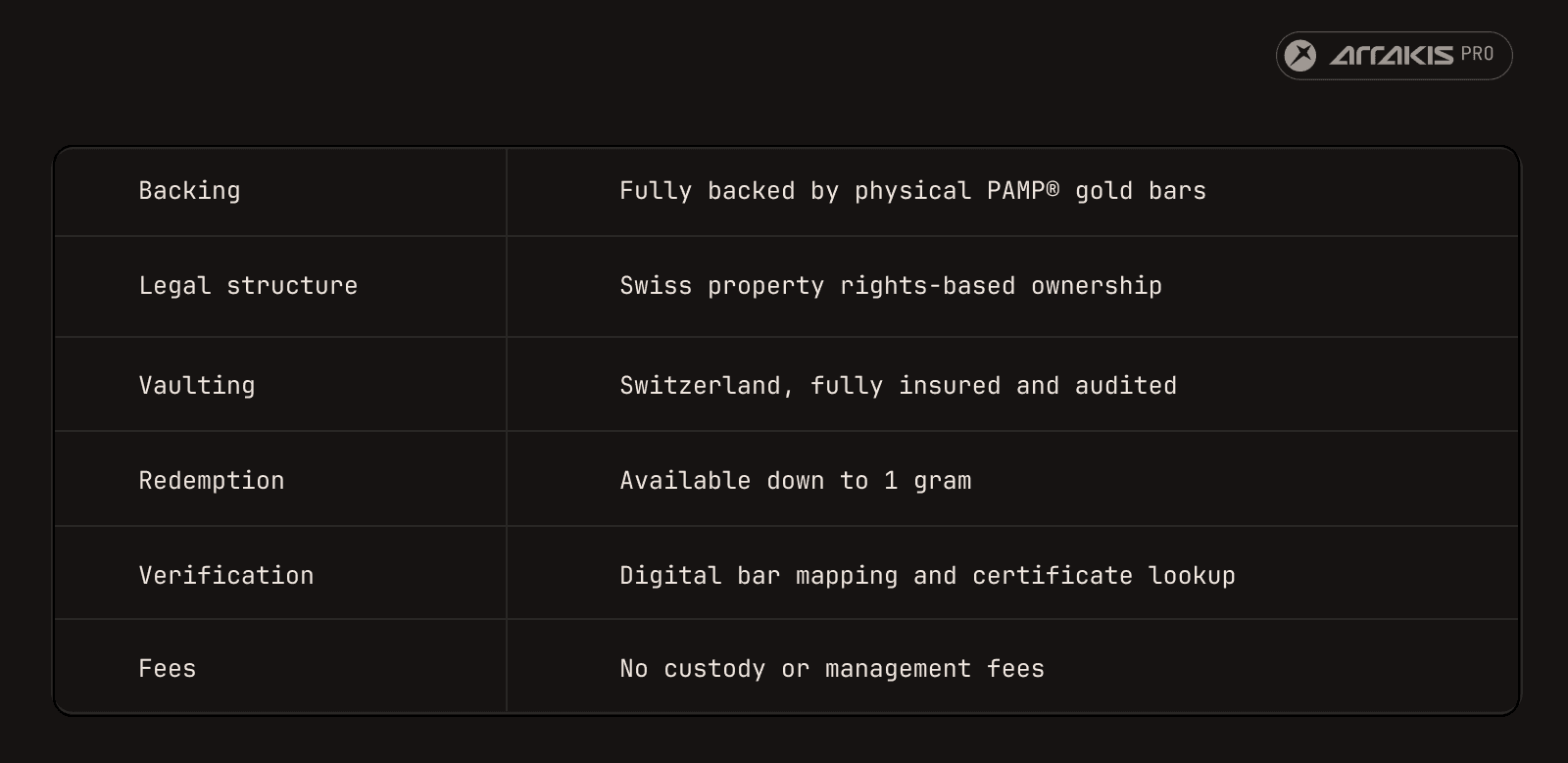

DGLD®, issued by Gold Token SA (GTSA), represents allocated ownership of vaulted PAMP® gold bars held in Switzerland. Each token corresponds to uniquely identifiable physical gold with full insurance, redemption optionality, and bar-level documentation.

Key characteristics of DGLD®

This model brings gold onchain with a level of verifiability and redeemability that moves beyond simple price tracking towards true digital gold ownership.

Making DGLD® Liquid and Execution-Ready

Tokenized gold behaves differently from most DeFi assets: it tracks the global spot gold market, is often moved in larger settlement transfers, and must maintain orderly markets especially during volatility when gold acts as a hedge against market volatility.

To meet those requirements, MKS PAMP is partnering with Arrakis Pro to launch deep, actively managed liquidity for DGLD® onchain.

Arrakis Pro × DGLD®: Liquidity Designed for Gold Onchain

Arrakis Pro concentrates liquidity tightly around the real-world spot price of gold, ensuring DGLD® trades at market-accurate levels onchain and traders can instantly redeem DGLD to USDC without any physical delivery.

The strategy is designed to:

Update the AMM pool’s price to reflect the real world gold price to not rely on arbitrageurs.

Maintain tight spreads and reliable two-sided depth, even during volatility.

Support larger trade sizes suitable for redemption flows, treasury operations, and institutional settlement.

Automatically update spreads during weekends to adjust to offchain market dynamics.

As gold enters programmable finance, its utility will depend on whether it remains liquid, executable, and settlement-ready on demand. Arrakis pro is designed to deliver exactly that.

Whether it's tokenized metals, yield-bearing dollars, credit RWAs, or treasury assets, the same principle holds: if it’s going to be used, it has to be liquid.

If you're designing or scaling an RWA asset and need institutional-grade onchain liquidity management, get in touch.