Dec 22, 2025

Case Study

TL;DR

Arrakis Pro took over management of Morpho’s DEX liquidity on Ethereum, transitioning from a self-managed Uniswap v3 pool to a Uniswap v4 pool at the same 0.3% fee tier.

Under the self-managed v3 setup, concentrated liquidity frequently drifted out of range during volatile periods, leading to elevated price impact on mid-sized trades.

With Arrakis Pro managing the pool, liquidity stayed in range through volatile and trending markets, delivering more stable execution.

Average trade size increased ($2.0k to $3.4k), while sell-side price impact on $5k trades dropped by around 60% (0.45% to 0.16%).

The result was more consistent liquidity depth and predictable execution for $MORPHO.

Concentrated-liquidity AMMs have made it easier than ever for token issuers to launch onchain markets. In practice, however, maintaining consistent trade execution quality over time requires more than simply deploying liquidity and setting a range.

As prices move, manually managed positions can fall out of range, capital becomes idle, and execution degrades. For token issuers, this often shows up as inefficient inventory usage, ongoing operational overhead, and increased exposure to impermanent loss during volatile periods.

Working with Morpho, we compared two approaches to liquidity management under real market conditions: Morpho’s self-managed liquidity on Uniswap v3 and liquidity managed via Arrakis Pro on Uniswap v4. In both cases, the pools represented Morpho’s deepest onchain liquidity venue during their respective periods. Despite this, their performance diverged meaningfully once volatility increased.

Setting the stage

Arrakis Pro is a fully onchain market-making solution designed for token issuers that seek to create deep onchain liquidity for their tokens. It actively adjusts liquidity positions in response to price movement, volatility, and inventory changes to keep liquidity in-range.

In stable market conditions, it can concentrate liquidity closer to the market price to maximize depth. As volatility increases, ranges are widened to reduce inventory risk and maintain predictable execution on both sides of the market.

Morpho’s deepest DEX liquidity profile on Ethereum in 2025 can be broken down into two time periods:

Self-Managed liquidity in a Uniswap v3 pool at the 0.3% fee tier (21.11.2024 - 27.05.2025)

Liquidity managed via Arrakis Pro on a Uniswap v4 pool at the 0.3% fee tier (01.06.2025 - 19.12.2025).

In stable market conditions, both setups functioned as intended. During periods of higher volatility, however, the differences between the two became clear.

Where self-managed liquidity became less effective

To do a fair comparison, we analyzed two comparable time windows of two months in 2025 each.

Pool | Time Period | Average TVL |

Pre-Arrakis (Uniswap v3) | Apr 1 to May 27 | $4.26M |

Post-Arrakis (Uniswap v4) | Jun 1 to Jul 31 | $3.10M |

Both periods experienced similar relative price volatility. The coefficient of variation was 21.4% in the earlier period and 18.2% in the later period, indicating broadly comparable market conditions.

Price Impact

To assess execution quality, we simulated $1k, $5k, and $10k swaps across both setups and measured price impact on buys and sells over the analysis period.

Despite operating with less total liquidity, the Arrakis Pro managed pool delivered lower and more stable price impact.

Historical impact of $1k, $5k and $10 buys and sells across both pools.

During periods of higher volatility, directional price moves frequently pushed the self-managed liquidity out of its concentrated ranges. When this happened, available depth dropped sharply, leading to irregular spikes in price impact.

In several instances, price impact in the self-managed pool reached multiple percentage points on mid-sized trades during the analysis period.

By contrast, the Arrakis Pro managed pool showed more stable behavior. Price impact remained consistently close to its average, with few sharp spikes, indicating that liquidity stayed better aligned with the market price even during short-term volatility.

Trade Size and Routing Behaviour

How large traders route their orders is a strong signal of liquidity quality on a DEX.

Over the analysis period, liquidity managed via Arrakis Pro consistently supported larger trade sizes than the self-managed pool.

Metric | Self Managed (V3) | Arrakis Pro Managed (V4) |

Avg Swap Size | $2,001 | $3,442 |

Median Swap Size | $1,766 | $3,181 |

Max Swap Size | $143,373 | $185,041 |

This pattern held even though the self-managed pool carried higher average TVL.

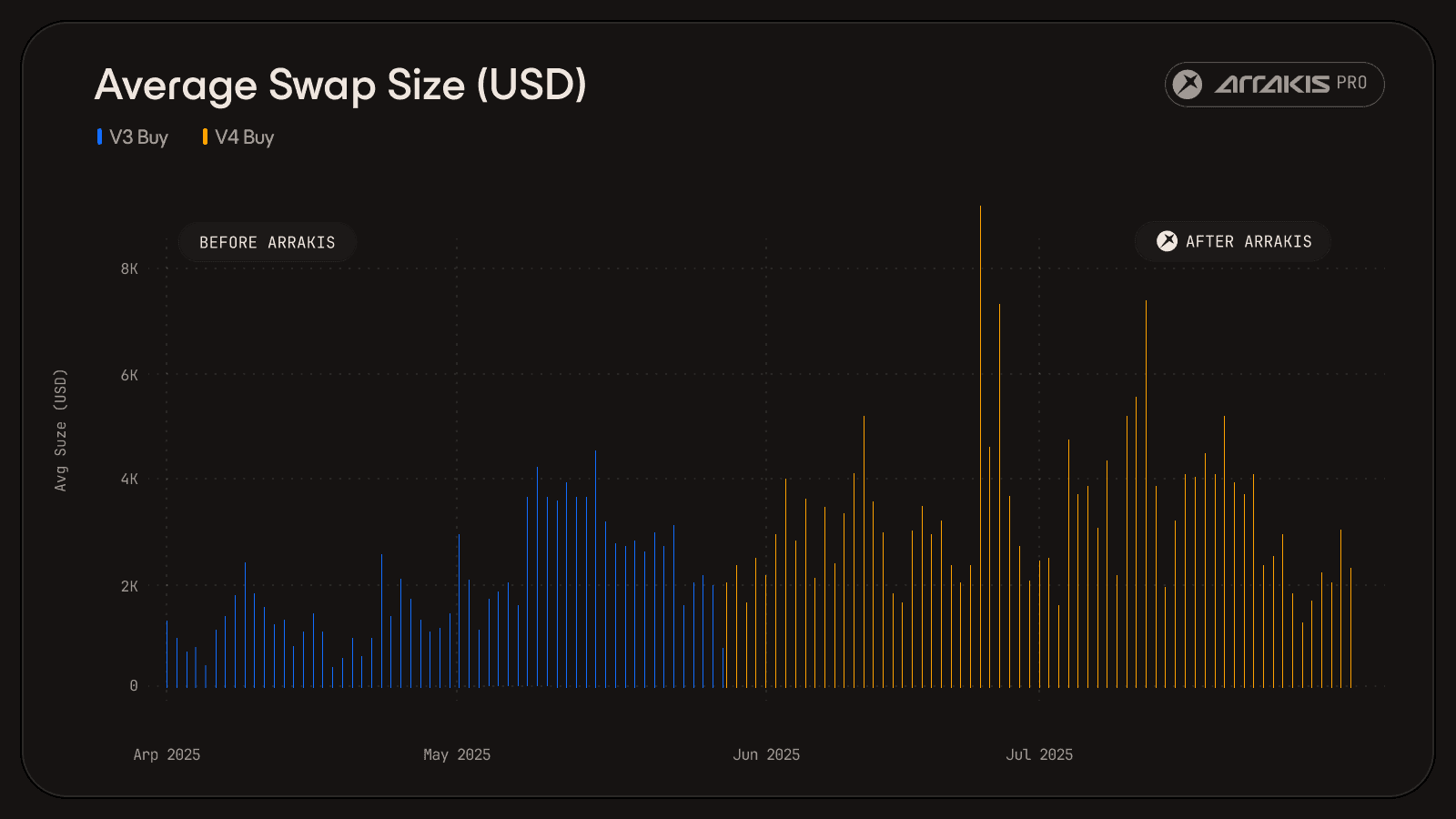

Chart visualising the average daily swap size data for manually managed liquidity and Arrakis Pro managed liquidity from 01.04.25 to 31.07.25

Note that, although TVL-normalized total volume was slightly higher in the Uniswap v3 pool over the analysis period ($29.9M versus $21.8M when normalized to the Uniswap v4 TVL baseline), not all of this volume was routed through Morpho’s self-managed liquidity, as self-managed positions accounted for only around 60% of the total inventory in the v3 pool, with the remainder provided by external LPs.

Inventory Composition and Imbalance

Inventory balance plays a key role in execution quality. When liquidity becomes skewed towards one side of the pool, the pool’s ability to absorb trades evenly begins to break down.

To measure this, we tracked how far each pool’s asset composition deviated from an ideal 50/50 MORPHO-ETH balance over time.

Chart visualising the liquidity composition data for self-managed and Arrakis Pro managed liquidity pools over the analysis period

Because up to 40% of the Uniswap v3 pool’s TVL came from external LPs, pool-level imbalance is an imperfect proxy for measuring Morpho’s inventory health. Even so, it provides a useful view into how inventory composition of the self-managed liquidity evolved over time.

The smoother inventory profile under the Arrakis management supported more symmetric market behaviour and helped limit impermanent loss for Morpho, particularly during periods of higher volatility.

Final Note

For token issuers, sustainable markets come down to a small set of fundamentals, with liquidity at the core.

Morpho’s transition from self-managed liquidity to algorithmic liquidity management via Arrakis Pro shows what active management can deliver under comparable market conditions, even with lower total TVL. The outcome was more consistent liquidity depth and predictable execution for $MORPHO.

If your team is preparing to scale liquidity or improve the stability of your markets, we would be happy to discuss how Arrakis Pro can support your goals.